Energy Shifts, Industrial Moves, and Space Ambitions

Good Evening,

The global energy landscape is evolving fast, with EDF extending UK nuclear plant lifespans and China approving 100 reactors to replace coal. Meta stirs the market with a major nuclear power bid to fuel its data centers. In M&A, Nippon Steel’s $15B play for U.S. Steel faces resistance, while Sateliot secures €30M to expand its nanosatellite network. Meanwhile, SpaceX sets another reusable rocket milestone, oil prices climb on inventory drops, and Europe’s manufacturing sector navigates new challenges following Northvolt’s bankruptcy.

Let's dive in.

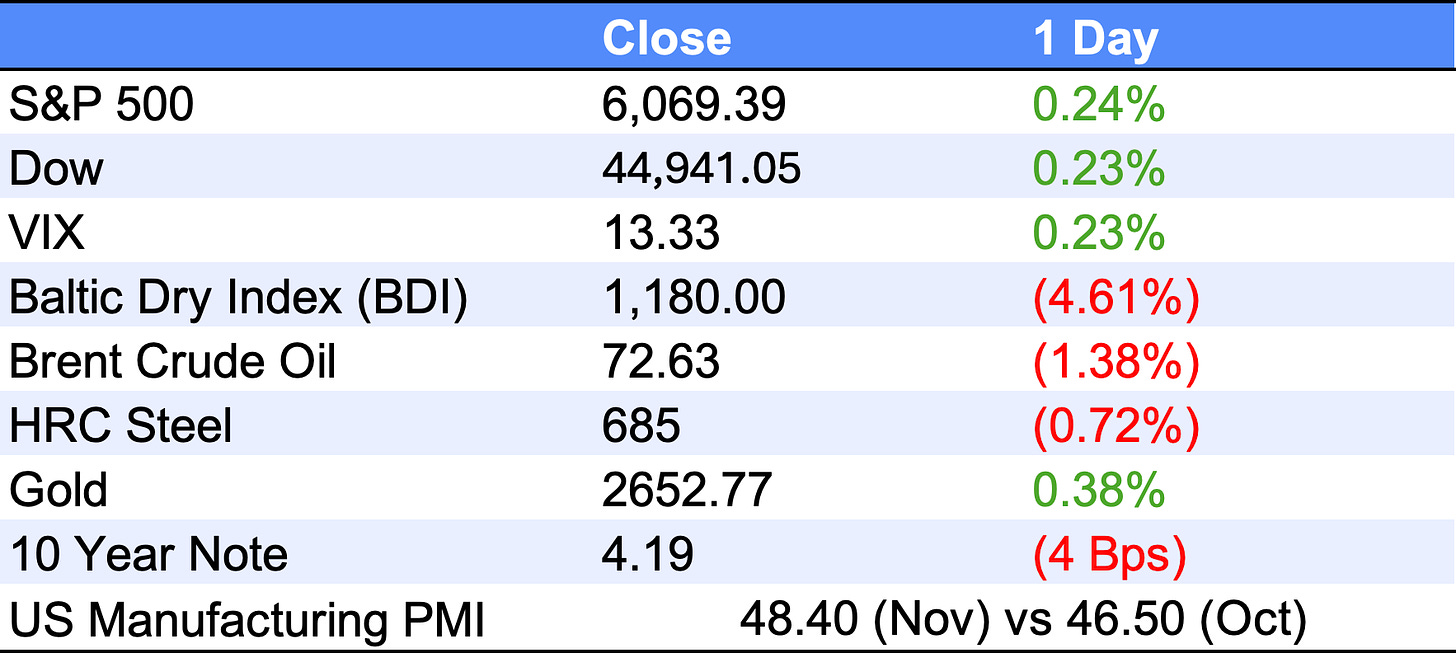

Closing Bell

Headline Roundup

Investment in green steel hinges on policy clarity, energizing stakeholders and greening industries (FT).

Meta seeks nuclear developers for data centers (HM)

DOE accelerates clean energy loans before Trump inauguration; U.S.-based manufacturers benefit (TC).

BlackRock, Vanguard, State Street sued by 11 states; alters global money management (AX).

EDF extends life of four UK nuclear plants to bolster energy security (OP).

Ex-GM chief Ammann leads Exxon's oil, gas unit post-low-carbon role (OP).

Deal Flow

M&A/Investments

European Investment Bank backs Sateliot with €30M to expand nanosatellite network, boosting IoT connectivity in remote areas. (SN)

British Steel might face nationalization as an alternative to stabilizing its partnership with the Chinese owner. (FT)

Nippon Steel's $15B bid for U.S. Steel faces opposition from President-elect Trump, Biden, and unions. (AX)

VC

FibreCoat, a German materials tech startup, raised €20M in Series B led by NewSpace and Goose Capital, focusing on space and defense markets. (SN)

Spanish startup PLD Space secured a loan for Miura 5 rocket site in French Guiana. (SN)

Lyten raised a $200M Series B, achieving unicorn status. For Lithium-sulfur batteries for EVs and energy storage. (HM)

Varda bags $48M Air Force deal to test reentry capsules—boosts payload tech. (SN)

Sateliot raised €30M from European Investment Bank to expand nanosatellite IoT connectivity. Trend: Global satellite IoT network race heats up. (SN)

Sector Signals

Aerospace and Defense

U.S. Navy grants X-Bow $60M to upgrade solid rocket facilities, boosting defense readiness and tech modernization.

Lockheed Martin asserts GPS resilience, countering vulnerability concerns. This demonstrates robust defense innovation, ensuring national security.

IRIS² advances SES and Eutelsat's NGSO capabilities, aiming to rival SpaceX's Starlink. This elevates Europe's broadband ambitions."

China's Long March 3B marks 100th flight, launching a secretive TJS-13 satellite, sparking defense industry curiosity.

ARX Robotics unveils Europe's first AI OS, transforming military vehicles into autonomous units; boosts NATO's defense tech edge.

Infleqtion nabbed an $11M Pentagon deal for atomic clock development, boosting GPS-alternative tech advancements.

Anduril scored a $100M Pentagon deal to expand its edge data mesh for real-time military insights.

SpaceX Falcon 9's 24th launch sets a record, proving reusable rockets' cost-efficiency. This enhances satellite deployment and shakes up aerospace economics.

Northrop Grumman activated Arctic satcom constellation for Space Force, Norway. Expands connectivity, enhances military communications in strategic Arctic region.

Sierra Space inks MOUs with two firms for space-based semiconductor manufacturing, using Dream Chaser tech.

Manufacturing

Northvolt's bankruptcy underscores supply chain fragility in manufacturing; Europe's battery hopes now hinge on new tech advances.

China plans to approve 100 nuclear reactors by 2035 to combat coal pollution, shifting manufacturing energy demands.

Commodities

Crude inventory dropped by 5.1M barrels last week, boosting oil prices amid supply concerns.

Russia’s oil revenues dropped 21% in November, driven by declining Urals prices and global demand concerns. Industries relying on Russian oil

Hungary seeks U.S. sanctions waiver for Gazprombank, spotlighting Europe's complex energy dependency. Potential price volatility looms.

Nuclear power heats up: Meta's 1-4 GW bid rivets industry, sparking energy market innovation buzz.

Contract Watch

Shimmick Construction (SHIM) secures a $5.6M contract with the Bureau of Reclamation for monorail construction.

Widepoint (WYY) locks in $4.3M contract with the US Secret Service.

Tetra Tech (TTEK) received $83.1M from the Agency for International Development to increase African grid infrastructure.