$1.42 trillion US dollars is the expected revenue of all global communications (1). That is your headline number and your TAM number for all you communications entrepreneurs. What does this number truly mean? How accurate is this number? I really couldn’t tell you. What is more exciting is how this revenue is generated and how space will disrupt this number. With my experience at SpaceX and at Kepler Communications, that is a topic I can shed some light on. Before we jump into the exciting frontiers of space-based communication, we must first understand the existing technologies and market players.

ISPs (Internet Service Providers) are responsible for providing customer access to network and internet services for a fee. This access is often referred to as bandwidth and depends on the type of ISP and the service location. These ISPs buy bandwidth from various sources, including:

Tier 1 ISPs: These are large ISPs that own and operate their networks and sell excess capacity to other ISPs.

Wholesale providers: These companies purchase large amounts of bandwidth from Tier 1 ISPs and other sources and then resell it to other ISPs and customers at a markup.

Peering agreements: ISPs can exchange traffic with other ISPs through peering agreements, allowing them to access each other's networks and bandwidth.

Transit providers: ISPs can also buy transit from other ISPs, which allows them to access the entire internet via a single connection.

Submarine cables: ISPs can also buy bandwidth from submarine cable operators, which provide high-speed connections between continents and countries via undersea fiber-optic cables.

Satellites: ISPs can also buy bandwidth from satellite providers, which allows them to offer internet services in remote areas or places where it would be difficult or impossible to lay fiber-optic cables.

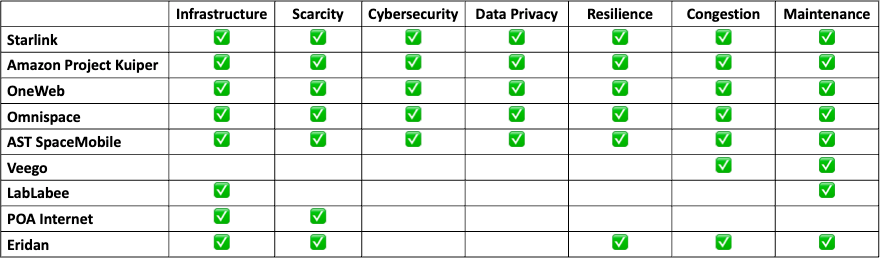

These processes and interactions between different market players are still highly manual and rely on aging infrastructure. This intern results in a less-than-ideal customer experience (limited and unreliable coverage at expensive rates). This is where space startups are hoping to innovate. To help organize the current startup landscape, I created the visual below, aligning startups with the major problems they hoping to solve. I have also further described what these problems mean and how they impact the ISP service.

The problems with the current ISP network:

Network infrastructure: Building and maintaining a reliable network infrastructure can be costly and challenging, especially in remote or underserved areas.

Bandwidth scarcity: ISPs may have difficulty obtaining sufficient bandwidth to meet the demands of their customers, especially during peak usage times.

Cybersecurity: ISPs are responsible for protecting their networks and customers from cyber-attacks and other security threats, which can be a significant challenge.

Data privacy: ISPs collect and store large amounts of data on their customers and may face pressure to protect that data from hackers and other cybercriminals.

Natural disasters: ISPs are vulnerable to natural disasters such as floods, hurricanes, and earthquakes, which can damage network infrastructure and disrupt service.

Internet congestion: As the number of users and devices connecting to the internet increases, ISPs need to manage the network traffic and congestion to ensure good service for their customers.

Upgrade and maintenance: ISPs need to keep up with the rapid evolution of technology and upgrade their infrastructure, software, and hardware to meet the needs of their customers.

There certainly is a lot to digest here, and this certainly just scratches the surface. One immediate takeaway is that, yes, there are a lot of space startups disrupting communication, but there are also a lot of software-first solutions complementing these space startups. Innovation in both sectors will help push the industry forward.

In my next newsletter, I will take a deep dive into space hardware startups, detailing how a constellation of satellites can provide internet coverage—the challenges these startups are facing and how they are overcoming them.

Sources:

(1) https://www.statista.com/outlook/tmo/communication-services/worldwide